September 15 2022 will probably be one of the most important days for the crypto market in the last few years.

On the Internet today, you can find a lot of news and information about “the merge”, which are not entirely clear to all participants in the crypto exchange, and especially not to those beginners.

When the Merge officially kicked in at 2:43 AM EST, over 41,000 people were tuned in on YouTube to an “Ethereum Mainnet Merge Viewing Party.” They watched with bated breath as key metrics trickled in suggesting that Ethereum’s core systems had remained intact. After around 15 long minutes, the Merge officially finalized, meaning it could be declared a success.

The second biggest cryptocurrency, Ethereum, has switched over to a new operating model that uses 99.9% less energy.

The change, called The Merge, is designed to win over critics who see cryptocurrencies as environmentally harmful.

Ethereum currently uses as much energy as a medium-sized country.

Other cryptocurrencies, including the biggest, Bitcoin, will remain as energy-intensive as before.

- What exactly is “the Merge” and what does it actually mean for Ethereum?

Ethereum Merge is a transition, not a replacement for Ethereum.

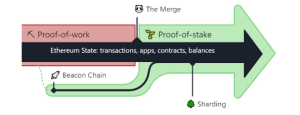

The Merge was the joining of the original execution layer of Ethereum (the Mainnet that has existed since genesis) with its new proof-of-stake consensus layer, the Beacon Chain. It eliminated the need for energy-intensive mining and instead enabled the the network to be secured using staked ETH. It was a truly exciting step in realizing the Ethereum vision—more scalability, security, and sustainability.

Picture source: https://ethereum.org/en/upgrades/merge/

It probably will be one of the most considerable moments in crypto history as Ethereum goes through this monumental change.

It was not a small feat swapping out one way of running a blockchain, known as proof-of-work, for another, called proof-of-stake.

Justin Drake, a researcher at the non-profit Ethereum Foundation said for CoinDesk “The metaphor that I use is this idea of switching out an engine from a running car,” before the Merge happened.

“I like to think of it as kind of like the switch from gasoline to electric.”

Mark Cuban, investor and billionaire owner of the Dallas Mavericks basketball team, told CoinDesk he would be “watching [the Merge] with interest like everyone else,” pointing out that it might make ETH, the network’s native token, deflationary.

What will Ethereum Merge bring?

- The Ethereum blockchain will transition from proof-of-work (PoW) to proof-of-stake (PoS).

- The Merge will reduce Ethereum’s energy consumption by 99.95%.

Ethereum miners are assumed to be paying 10 cents per KWh on average. This is due to the fact that Ethereum runs Ethash, an “ASIC-resistant” proof-of-work algorithm. Application-specific integrated circuits (ASICs) led to the industrialization of Bitcoin mining, while Ethereum mining is done with Graphics processing units (GPUs) found in every home computer.

3. The blockchain will become more scalable in terms of its use cases.

4. Beacon Chain’s PoS algorithm will replace Ethereum’s current mainnet permanently.

“We believe post-merge the bull case for ethereum is going to be a lot stronger for a number of reasons,” said Katie Talati, head of research at asset management firm Arca. The main factor, she says, is that supply is going to come way down, creating scarcity.

The hallmark of ethereum’s big makeover is that it will take a lot less energy to verify transactions, which has long been a major problem for the crypto industry. The proof-of-stake model, which is replacing the proof-of-work model, requires validators on the network to put up their ether tokens, or “stake” them, essentially pulling them out of circulation for an extended period of time, in order to secure the network.

“For probably six to 12 months — there’s no defined guidance yet from developers on ethereum — you will not be able to withdraw your ethereum once you’ve staked it to validate the network,” Talati said.

- The Merge did not change anything for holders/users.

As a user or holder of ETH or any other digital asset on Ethereum, as well as non-node-operating stakers, you do not need to do anything with your funds or wallet to account for The Merge. ETH is just ETH. There is no such thing as “old ETH”/”new ETH” or “ETH1″/”ETH2” and wallets work exactly the same after The Merge as they did before—people telling you otherwise are likely scammers.

Despite swapping out proof-of-work, the entire history of Ethereum since genesis remained intact and unaltered by the transition to proof-of-stake. Any funds held in your wallet before The Merge will are still accessible after The Merge. No action is required to upgrade on your part, according to officials at ethereum.org.

- Goodbye miners, hello stalkers!

CoinDesk wrote regarding the energy efficiency “From an energy costs perspective, it’s like Finland suddenly shut off its power grid”, according to one estimate.

The Merge retires Ethereum’s proof-of-work system, where crypto miners competed to write transactions to its ledger – and earn rewards for doing so – by solving cryptographic puzzles.

Most crypto mining today happens in “farms,” though they may be more aptly described as factories. Picture massive warehouses lined with rows of computers stacked on top of one another like shelves of books at a university library – each computer hot to the touch as it strains to pump out cryptocurrency. This system, which was pioneered by Bitcoin, is what caused Ethereum to guzzle so much energy and is responsible for fueling the blockchain sector’s reputation as an environmental menace.

Ethereum’s new system, proof-of-stake, does away with mining entirely.

Miners are replaced by validators – people who “stake” at least 32 ETH by sending them to an address on the Ethereum network where they cannot be bought or sold.

These staked ETH tokens act like lottery tickets: The more ETH a validator stakes, the more likely one of its tickets will be drawn, granting it the ability to write a “block” of transactions to Ethereum’s digital ledger.

Ethereum introduced a proof-of-stake network in 2020 called the Beacon Chain, but until the Merge it was just a staging area for validators to get set up for the switch. Ethereum’s transition to proof-of-stake involved merging the Beacon Chain with Ethereum’s main network.

According to Beiko, the energy consumption of proof-of-stake is “not even a rounding error in terms of environmental impact.”

Beiko explained “Proof-of-work is a mechanism by which you take physical resources and you convert them into security for the network. If you want your network to be more secure, you need more of those physical resources. On proof-of-stake, what we do is we use financial resources to convert to security.”

Although Ethereum had thousands of individual miners operating and securing its proof-of-work network, computers from just three mining pools dominated a majority of the network’s hashrate, a measure of the collective computing power of all miners.

- Should you invest or wait for a while?

According to Jaydeep Korde, CEO of ethereum infrastructure builder Launchnodes, “whether to buy now or wait and see how the merge goes depends on an investor’s time horizon for holding the coins”. Korde tells CNBC that traders who plan to sit on their stake for the long term — in the range of two to three years — should be in good shape.

“If you’re looking in the shorter-term horizon in terms of trading, I think that it’s much more volatile,” Korde said. He cited global economic conditions, geopolitics and inflation as playing into the immediate risk. Korde said that “Ethereum will suffer the challenges of that volatility, like every other asset class” .

With the upgrade, Ethereum won’t become faster, cheaper or more scalable. One developer even told CNBC that if the user experience feels the same, that will be one sign that the merge was a total success.

The real investor draw is the slashing of energy usage, especially as bitcoin mining continues to face blowback for its growing power consumption.